Key takeaways:

- Tips to maximise your super returns, such as account consolidation, fees comparison, and choosing investment options.

- An overview of government services available to help boost your super.

Super is like a financial safety net that ensures you’ll have a comfortable retirement. But here’s the kicker – you can’t just set and forget it, or at least, not if you want to maximise its value. To make your golden years truly golden, you need to actively grow your super.

Here, we’ll walk you through some effective ways to turbocharge your super so you can enjoy retirement to the fullest.

Start early to grow your super

The power of compounding returns is your best ally when it comes to growing your super. The earlier you start contributing, the more time your savings have to grow. Even if you can only contribute a small amount every week or month, it adds up over time.

If you’re in your 20s or 30s and you think retirement seems too far away to give much thought to, don’t wait! Get started today and you’ll thank yourself later.

Make extra contributions to grow super

Life can be expensive, especially right now with inflation on the rise and cost of living pressures being keenly felt, so it’s not always easy to find extra cash to boost your super contributions. But if you can manage it, contributing more than the minimum can pay off big time.

You can make concessional contributions, such as salary sacrificing, which are also tax-effective. Or, you can make non-concessional contributions, where you use your after-tax income to top up your super. Just be sure to stay within the contribution caps set by the Australian Taxation Office (ATO), or you could end up with a tax penalty.

Consolidate your super accounts to grow super

A common mistake many people make is having multiple super accounts. You might have one or two from previous jobs, one from your current role, and perhaps even another from some freelance work you did on the side.

Having multiple accounts means paying multiple sets of fees, and that can really eat into your retirement savings, so do yourself a favour and consolidate your super accounts. It’s an easy fix – just hop onto the MyGov website and use their handy tool to roll all your super into one account. Full details of where to go can be found on the ATO’s website. Not only will you save on fees, you’ll also have a clearer picture of your total super balance.

Choose the right investment option to grow super

Your super isn’t just a giant piggy bank – it’s invested in different assets like shares, bonds, and property. And guess what? You have a say in how your super is invested!

Most super funds offer a range of investment options, from conservative to high growth. The key is to choose an option that matches your risk tolerance and investment goals.

If you’re young and have time on your side, you may want to consider a growth option that leans more towards shares. They tend to offer higher returns in the long run, even if they can be a little bumpier along the way. If you’re closer to retirement and want to protect your nest egg, a conservative option with more bonds might be your cup of tea. It’s all about finding the right balance for you.

Keep an eye on fees to grow super

Fees are the silent super killers. They might seem small, but they can add up over the years and eat into your retirement savings. All super funds charge fees, but the key is to find a fund with competitive fees and features that suit your needs.

Look out for admin fees, investment fees, and any other charges that might apply. Remember, cheaper doesn’t always mean better. Sometimes, a fund with slightly higher fees might provide better returns, so it’s all about finding the sweet spot.

Take advantage of government incentives to grow super

The government is pretty keen on helping you grow your super, as ultimately, it reduces our dependence on the Age Pension.

There are a couple of incentives you should know about. First, there’s the government co-contribution. If you’re a low or middle-income earner and you make personal contributions to your super, the government will chip in and make contributions for you (up to $500). It’s like a little bonus to boost your retirement savings.

Then there’s the spouse contribution. If your spouse is out of the workforce or earns less than $40,000 per year, you can make contributions to their super and get a tax offset in return. It’s a win-win – you help your partner grow their super, and you get a tax break.

Review your insurance needs

Most super funds offer insurance options such as life insurance, disability cover, and income protection. While these can be handy, they also come with fees that can eat into your super balance.

It’s important to review your insurance needs and make sure you’re not paying for coverage you don’t need. If you have other insurance policies in place through your job or a private policy, you might be able to dial back your super insurance and save some money.

Check your super statements

Reading your super statements might not be one of the most exciting uses of your spare time, but it’s one of the most valuable and essential.

Your super statement tells you how your investments are performing, how much you’ve contributed, and how much you’re paying in fees. It’s like your financial report card. Regularly checking your super statements helps you stay on top of your retirement savings and make adjustments if needed.

If in doubt, seek professional advice

Growing your super can be a bit like navigating the outback – it’s a lot easier with a guide.

If you’re not sure where to start, or just want some expert advice, consider talking to us or speaking to a planner who specialises in super. We can help you create a tailored strategy to maximise your super and reach your retirement goals.

Be patient

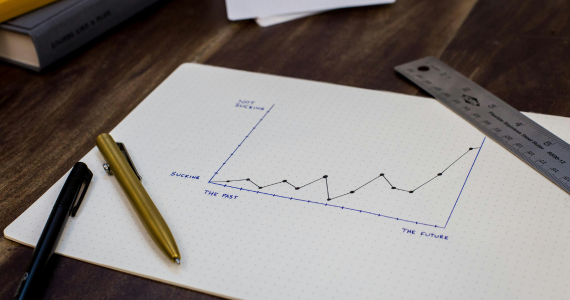

Growing your super isn’t a get-rich-quick scheme; it’s a long game, and there will be ups and downs along the way.

The key is to stay patient and stick to your plan. Remember, your super is there to provide for your retirement, so it’s all about seeing the big picture. With time, effort, and a bit of financial savvy, you could be well on your way to a very comfortable retirement.

Based on KPMG Super Insights 2023 Report as at May 2023 KPMG Super Insights 2023 Report